A couple of weeks ago, the following email landed in our support inbox:

“WOW…PROFITS FIRST? Really? Not ‘PEOPLE FIRST’? Really doesn’t say much about the corporate culture there.”

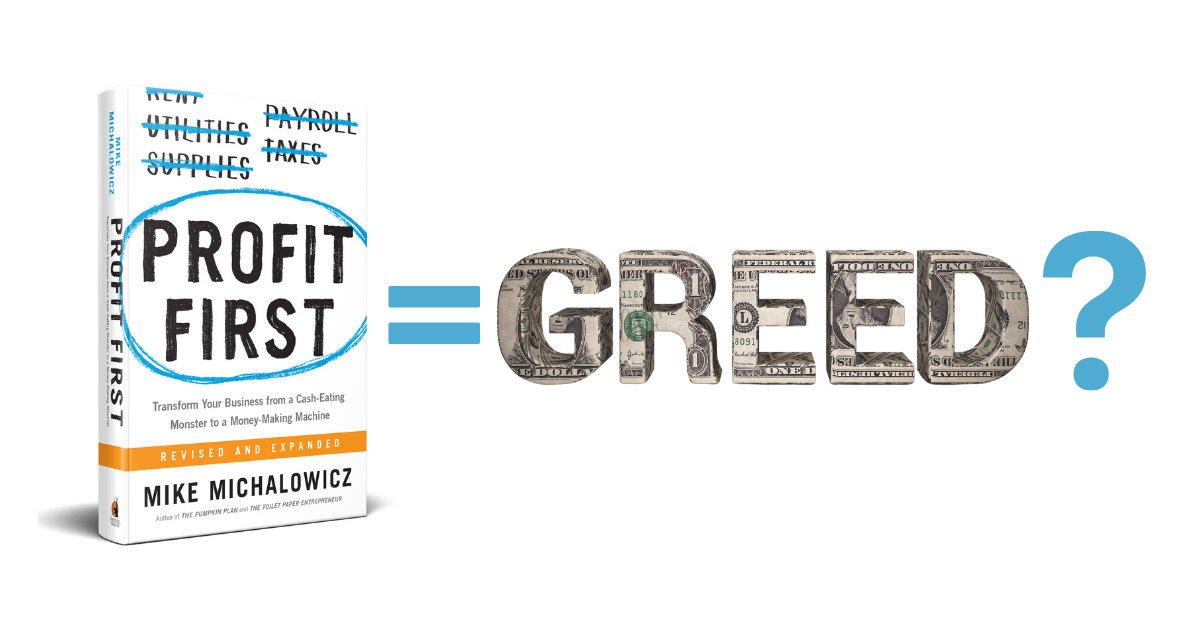

And that got me to thinking: It’s time to write a blog about this particular elephant in the room.

Profit and corporate greed

We’ve all heard the headlines: Corporations are reporting record profits during a time when it’s becoming increasingly difficult for families to afford a carton of eggs. At the same time, executives at many of these same companies are paid tens of millions of dollars in salaries and other benefits.

Meanwhile, workers’ wages are increasing…but not enough to offset the rising costs of basic necessities. Yet, rising workers’ wages are one of the things blamed for inflation.

This article isn’t about all that.

Of course, the headlines rarely tell the full story, and I’m not going to argue whether or not certain executives deserve millions of dollars in compensation.

But it does shed a pretty bright light on why many people – financial professionals included! – are opposed to the concept of “Profit First.” Because, when you look at profit from this perspective, there’s very little positive about it for most people.

Profit in the “real world”

Let’s look at profit in the “real world.” I’m not saying large corporate profits don’t have real world impacts but remember: This article isn’t about all that. What I am saying is that, for most businesses in America, “profit” has a very different meaning than what most of us think when we hear the word.

What does profit really mean for small businesses? It means the ability to

- Hire more workers and pay them higher wages.

- Provide those workers with life-changing benefits, like paid medical leave if they get sick or have a sick family member.

- Upgrade equipment with more frequency, which makes work safer and more pleasant.

- Sponsor a Little League team, build a Habitat for Humanity Home, or contribute to a community garden.

And what about owners’ wages? Well, profit – especially under the Profit First methodology – does two things:

- It makes sure the owner is paid a living wage for working in their business. Have you ever worked for an employer who was concerned about making their mortgage payment? It doesn’t make for a very pleasant work environment, and it often leads to the employer making some pretty bad business decisions…decisions that compromise not only the owner’s livelihood, but the livelihood of every employee in the business.

- It puts guardrails on the owner’s overcompensation. If you’ve never worked for an employer who was worried about making their mortgage payment, perhaps you’ve worked for one who raids the business checking account to purchase a new car and then asks you to wait a few days for your paycheck. Profit First ensures the business owner gets compensation increases as the business grows – as they should – while acknowledging that a growing business will require more funds for operating expenses…like employee salaries.

Profit First is the antithesis of corporate greed

As a methodology, Profit First is designed not only to help small businesses operate profitably. Its percentage-based and scaled format virtually eliminates “runaway profits” and “corporate greed.”

At the highest level of Real Revenue (revenue after accounting for pass-through costs), the Profit target allocation percentage maxes out at 20%. Granted, 20% of $10M-$50M is a LOT of money…but so is 65%, which is the amount allocated to Operating Expenses at that level. That’s $6.5M-$32.5M for worker salaries, benefits, and other expenses that support the business.

I’ve implemented Profit First in dozens of businesses. Some of those businesses have grown into multi-million-dollar companies. And in every single case when a business using the Profit First methodology has hit the multi-million-dollar level (and in most cases before they’ve hit that level), I’ve seen some combination of the following:

- Profit sharing with employees.

- Vaulting cash reserves with the express purpose of being able to continue to pay employees during a reduction in business revenues.

- Capital improvements to make work more pleasant for the employees.

- Employee wellness programs.

- Community giving, either through charitable contributions or service projects.

Profit First = People First

The employee in charge of our support inbox isn’t a Profit First Professional Guide or an accountant, bookkeeper, or business coach. However, she nailed the nature of Profit First in her response to the person who expressed concern about the corporate culture of a business implementing Profit First:

We totally understand how it sounds when we say to put Profit “First,” but it’s never meant over people. Profit First is a cash management method that ensures you put a percentage of your earnings into a designated “Profit” account to ensure that your business stays profitable and sustainable.

This company has been the most family-friendly of any that I have ever worked for, the first that has said they are “family first” and meant it. But – our goal is to eradicate entrepreneurial poverty and to make that happen, we have to convince people to pay themselves first.

Only sustainable businesses can put people first, and Profit First keeps businesses sustainable.

Comments